Insurance is dull, right? Trov is a service that might change your mind. It makes the process of protecting your treasured items easy and flexible… and maybe even fun.

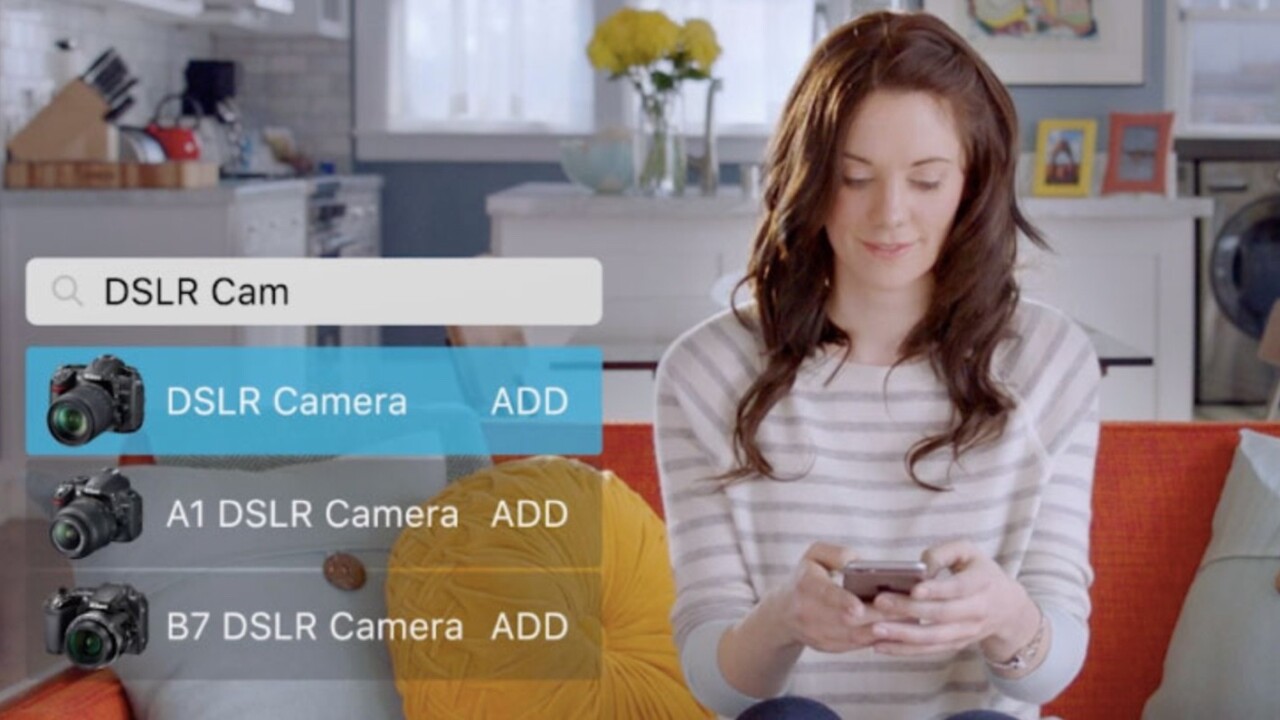

Trov’s mobile app lets you list items that you own, like gadgets or bicycles, and then switch insurance cover for each of them on and off as you need. For example, you might not want to pay to insure your camera all year, but you could you get cover for the duration of your vacation with a tap of your finger.

If the worst happens, the claims process is done via a text-based conversation with the company. This is most definitely aimed at the generation that will avoid phone conversations at every opportunity.

Launching in Australia today, and the UK later in the year, Trov covers items against damage, loss and theft. It’s an expansion of the current Trov app, which lets you organize an inventory of your possessions.

While many people have home contents insurance to protect their belongings, it often doesn’t include items outside the home, and you wouldn’t necessarily want to pay a flat fee to cover things that are rarely at risk.

Trov may just have found a flexible solution that is not only convenient, but it gets younger people engaging more with the insurance industry. No wonder, then, that the company has just raised $25.5 million in Series C funding and has partnered with traditional insurers Suncorp Group in Australia and AXA in the UK to launch the service.

Trov plans to expand to the USA and other markets next year.

Get the TNW newsletter

Get the most important tech news in your inbox each week.