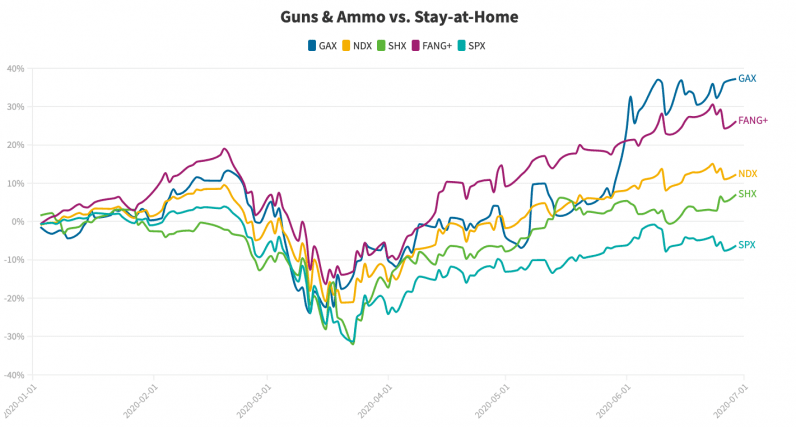

‘Stay-at-home’ stocks like Netflix and Zoom thrived in the first half of 2020. But as Black Lives Matter protests swept across the US in June, a very different kind of company surged: guns and ammo stocks.

Not only have US-listed guns and ammo stocks outperformed the world’s biggest tech companies this year, but they’ve even eclipsed companies that benefitted most from the world’s transition into remote work and education.

[Read: No, THIS is how much $10K worth of dot-com bubble stock is worth today]

In fact, when the S&P 500 (SPX) index, a popular benchmark for the wider US market, fell by more than 2% last Friday to erase all of its June gains, tech giants and stay-at-home stocks followed suit. But almost simultaneously, guns and ammo stocks rose by a similar amount.

Guns and Ammo vs. Stay-at-Home

To compare stay-at-home stocks against guns and ammo, Hard Fork built two new indexes: the Guns and Ammo 7 (GAX) and the Stay-at-Home 21 (SHX), having first debuted the GAX earlier this month.

Aside from those two, we used the NYSE’s FANG+ index to chart US tech giants like Amazon and Apple, the NDX as a benchmark for the wider tech sector, and the SPX to gauge the overall US market.

For the SHX, we adopted the list of stay-at-home stocks shared by CNBC’s Jim Cramer a few weeks back, but we’ve added social media vanguard Twitter into the mix just for good measure.

Overall, SHX is up 7%; FANG+ 26%; and NDX 12%. On the other hand, GAX is up a teeth-clenching 37%. The wider US market (as shown by SPX) is negative for the year, down 6.3% as of market open on June 30.

GAX and SHX: Top performing stocks

The GAX surge can be attributed to stellar rallies by ammo makers Vista Outdoors (VSTO) and Smith & Wessen Brands (SWBI) — both more than doubled in value this year.

In supporting roles, Sportsman’s Warehouse (SPWH), which sells semi-automatic rifles like the AR-15, is up 78% year-to-date, while firearm aficionados Sturm & Ruger is up 55%. Now, the real trick for the GAX is to retain its spectacular growth in the second half of 2020.

As for our internet-adjacent stay-at-home stocks: the endlessly-bullish video comms firm Zoom Video returned the most, up 262% for the year. Craft marketplace Etsy and ecommerce darling Shopify were the next best, having risen by 128% and 126% respectively.

Update 16:55, June 30: This piece has been updated to adjust the SHX and GAX indexes so that they are price weighted, much like the Dow Jones index.

Get the TNW newsletter

Get the most important tech news in your inbox each week.