Berlin’s corporate carbon accounting platform Plan A has just received a fresh boost of capital in the form of $27mn from Lightspeed Venture Partners, Visa, and others. The ESG reporting SaaS startup will use the money to double its headcount to 240+ employees and expand market presence across Europe, particularly in Scandinavia, France, and the UK.

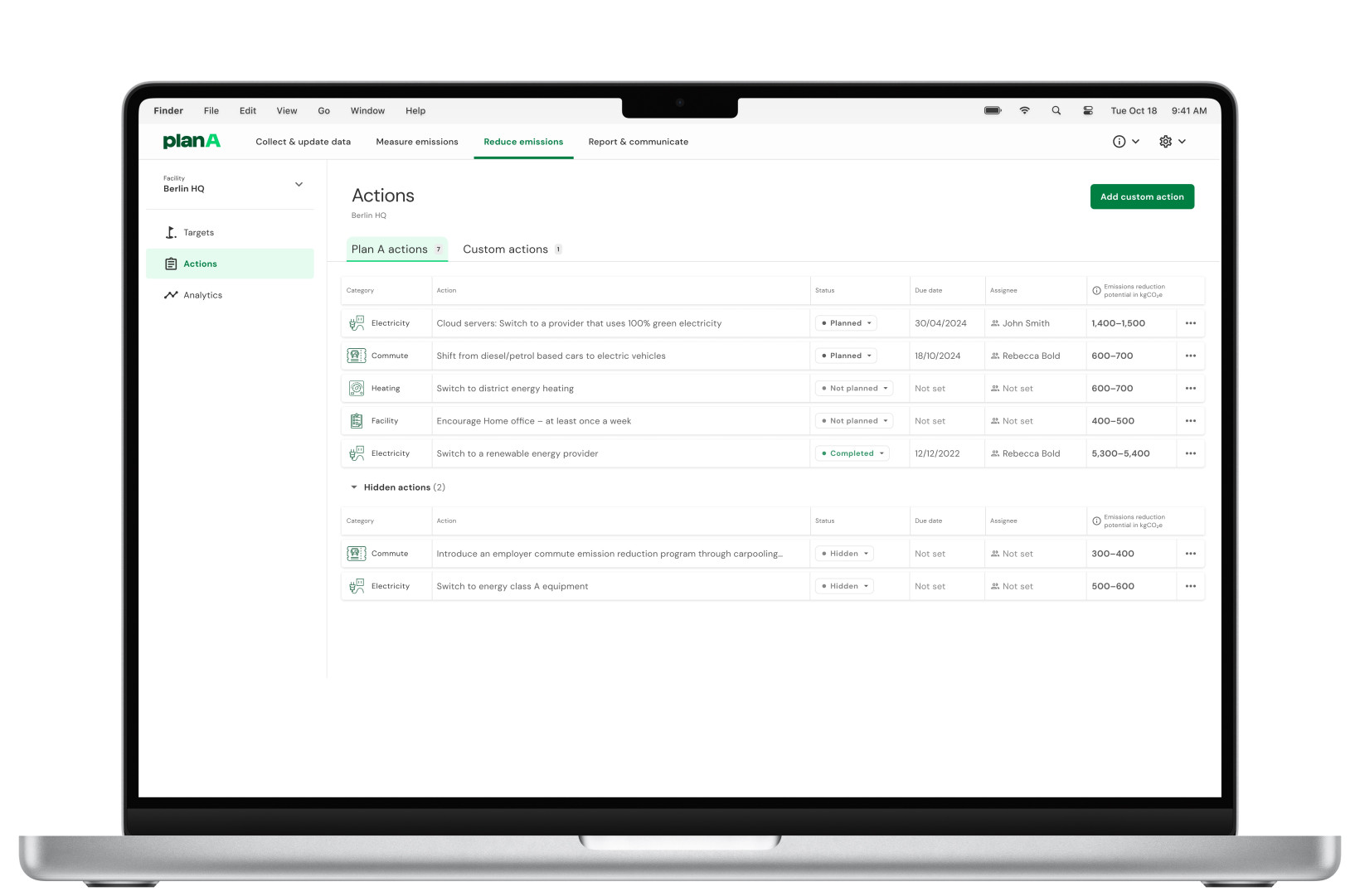

Greentech software provider Plan A was founded in 2017 by Lubomila Jordanova and Nathan Bonnisseau. Its platform offers companies — waking up to increasing climate risk and under mounting pressure to decarbonise operations — the possibility to “self-manage” their entire net-zero journey. This includes data collection over emissions calculation, target setting, decarbonisation planning, and non-financial reporting.

“Climate change and the associated impacts pose an existential risk to businesses. It’s our mission at Plan A to provide made-to-measure software solutions and services to empower large and complex companies to decarbonise their operations and value chains and respond to the regulatory shift,” Jordanova, the company’s CEO said in a statement. She further added that Plan A was “over the moon to bring these stellar investors onboard.”

Other participants in the round include Deutsche Bank, Opera Tech Ventures, and unicorn tech founders from Supercell, Aiven, Zalando, and Wolt, as well as existing investors HV Capital, Keen Venture Partners, Demeter IM, and coparion.

And a prudent investment it may prove to be. The carbon accounting software market (not to be confused with carbon offsets and credits), valued at $12.73bn in 2022, is expected to reach $64.39bn by 2030. This will likely be driven by increasing regulations to meet global net-zero targets, along with demands from larger investor organisations (such as pension funds), and increased risk to business infrastructure from climate change itself.

Top 10 in carbon accounting software industry globally

Plan A, which already counts companies such as Chloé, BMW, Deutsche Bank, Visa, HomeToGo, trivago, and DFB among its 1,500+ list of customers, was able to demonstrate growth in software revenues of over 600% year-on-year for December 2021-2022.

This has landed it with a top 10 spot in lists of carbon accounting software industry leaders — and renewed confidence from returning investor and exclusive global partner Lightspeed.

“We’ve been closely following the journey of Lubomila and the entire Plan A team over the past years and it has become incredibly clear to us that they have positioned themselves as a leader in this space,” said Julie Kainz, partner at Lightspeed Ventures. “The strength and flexibility of their platform truly has the capabilities to drive change and impact within organisations from across any sector and on a global scale, and to guide organisations both small and large on a holistic decarbonisation journey.”

Notably, (in case you share our concerns over carbon accounting methodology in general) Plan A’s platform-embedded calculations and solutions are aligned with recognised scientific methodologies and standards, such as the Greenhouse Gas Protocol and the Science Based Targets initiative (SBTi). Furthermore, the scientific accurateness of the applied Corporate Carbon Footprint (CCF) calculation methodology is certified by TÜV Rheinland, one of the world’s leading verification bodies.

Get the TNW newsletter

Get the most important tech news in your inbox each week.