Well, it’s happened. Apple is no longer a creator of attractive goods and services you want in your life, now it’s officially a financial institution following profit at all costs, wooo!

Join me in giving a round of applause to the product that killed the Apple fan in me: the Apple Card!

As a brief refresher, the Apple Card is a credit card the tech giant has released in conjunction with Goldman Sachs. If you’re looking for a range of specifics about how the Apple Card works, I’d suggest checking out our explainer here. But no matter how much information you have, I can’t help but think it’s a terrible thing.

First off, yeah, I know how businesses work. They exist to make money. Apple hasn’t been making its hardware for the sheer joy of it, it’s done solely for profit. And that’s fine. It’s more that the Apple Card is counter to the business’ trajectory.

Look at it this way. Apple has traditionally made things for people to use — life-enriching products, if you will. Whether it’s old school hardware like computers, or new-fangled streaming services, Apple made things that let its consumers experience.

Its products put people at the centre, so they can control of their own world. Hell, even Apple Pay was built with this approach, as it allowed users access to their pre-existing bank accounts in a way they wanted.

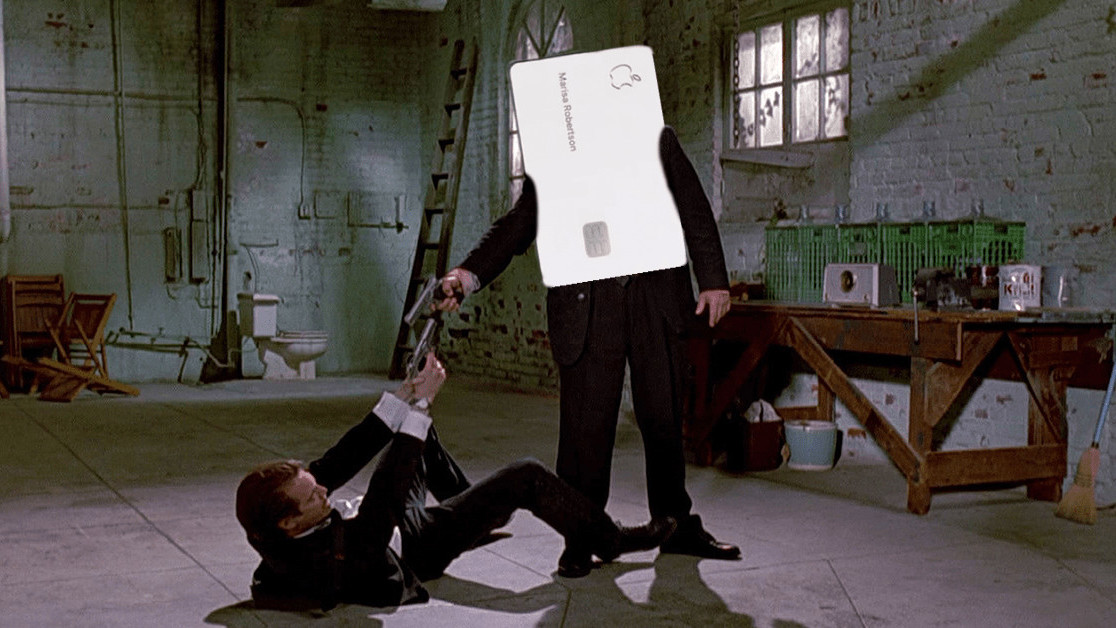

Apple releasing its own credit card is not in that spirit one bit. It’s not a supportive mentality, it’s an exploitative one.

If Apple had entered the market with a challenger approach, if it wanted to shake things up, I’d be intrigued. But it hasn’t done anything like that.

Despite the Apple Card having no annual, international, or late charge fees, the company is working with the financial behemoth that is Goldman Sachs. It’s still charging an intense annual percentage rate of between 13.24 and 24.24 percent — something completely in line with the rest of the credit card industry. You can even get the same spending breakdowns the product offers from huge numbers of banks.

Basically, the Apple Card is just another damn credit card.

Instead — rather than being innovative and exciting, you know, historically Apple — the company has basically shilled its customer base for profit. Everything about this feels like Apple knows it needs to keep on growing, and worked with a bank to squeeze some more money out of its loyal customer base.

The strategy? Convince people the Apple Card is completely different to other credit cards, get a whole load of people to sign up, and reap that sweet interest money from their purchases — all so it can keep on posting impressive profit margins.

You only need to search Apple Card on Google News to see how many publications have not only covered the launch, but done so in glowing terms. Could you imagine the release of another credit card getting this many column inches? And it’s all because Apple slapped its name on it to make some cash.

At best the Apple Card is a money grab, at worst it’s an exploitative campaign created to drive its customer base into debt for its own gain. But, for me, it’s one of the final nails in the coffin of the Apple I used to love.

Get the TNW newsletter

Get the most important tech news in your inbox each week.