Advanced Micro Devices (AMD) has officially acquired San Jose chipmaker Xilinx for a moustache-twirling $35 billion.

The deal is this year’s second largest tech disclosed acquisition, behind NVIDIA’s $40 billion buyout of mobile phone chipmaker Arm in September.

As a result, Xilinx (XLNX) shareholders will get 1.7234 AMD shares for each XLNX share held at the time of the acquisition. “Based on the exchange ratio, this represents approximately $143 per share of Xilinx common stock,” reads an AMD press release.

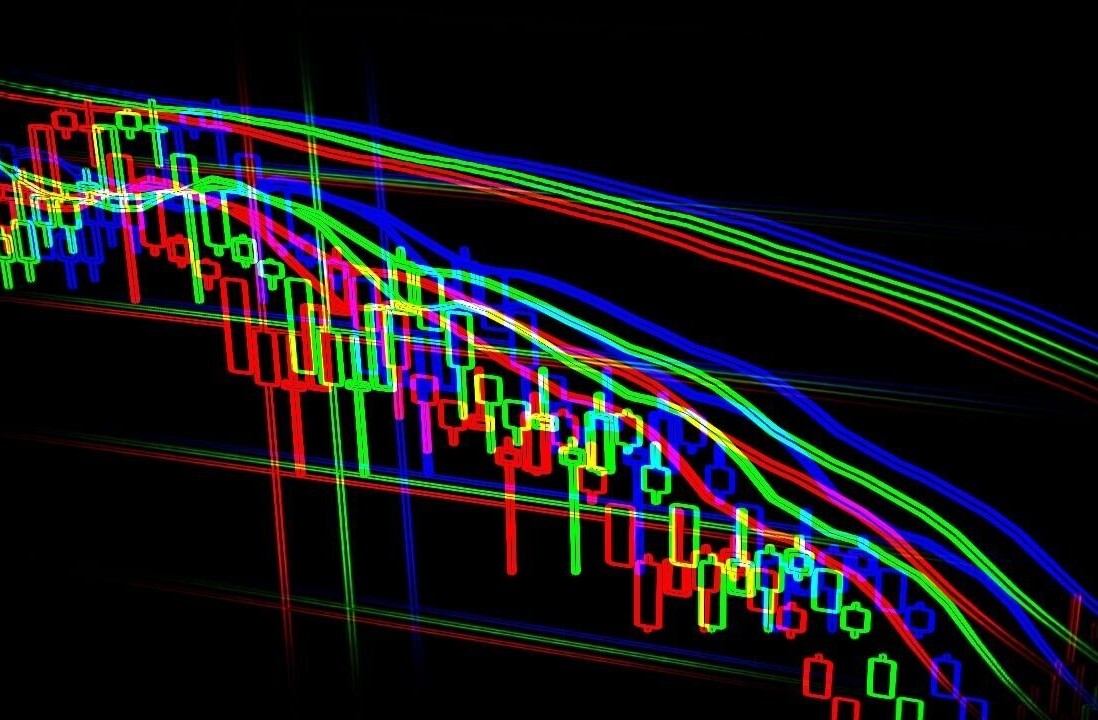

(If the visualizations below don’t show, try reloading this page in your browser’s “Desktop Mode.” 2020 tech acquisition list source: ComputerWorld)

XLNX rose 10% in the hours after the deal’s disclosure to $125.21, still 12% less than the $143 per share price estimated by AMD. AMD stock fell 5%.

XLNX’s current market value is a touch more than $30 billion, which is more in line with the rumored acquisition price that surfaced earlier this month.

AMD buyout did just the trick for XLNX’s stock price

XLNX is now up 30% year to date, bringing the stock six points ahead of the S&P Semiconductor Index, but well behind rampaging semiconductor stocks like NVIDIA (NVDA) and AMD.

It is however streets ahead of industry titan Intel, which has seen its stock price plummet more than 22% this year after reporting its second lacklustre earnings in a row.

[Read: NVIDIA takes the US chipmaker crown from Intel — a first since 2014]

On Intel, Wall Street insider Nancy Tengler told CNBC: “It had two bad quarters. There’s likely to be another one.”

The biggest US-listed chipmaker is really from Taiwan

In terms of sheer growth, NVDA has added more dollars to its market cap this year than practically any other semiconductor stock on the market.

NVDA began 2020 worth $147.5 billion — it’s now valued at more than $329.3 billion, $181 billion added in less than 10 months.

But Taiwan’s Taiwan Semiconductor Manufacturing Company is still the outright biggest.

The US-listed firm is worth nearly $405 million, more than 22% larger than runner-up NVDA and over twice as big as third place INTC.

Get the TNW newsletter

Get the most important tech news in your inbox each week.