There is no doubt that COVID-19 has changed the financial and SaaS landscape. This year is going to call for more judgment and effort to navigate the uncertainties brought on by the pandemic. Navigating these uncertainties often spell chaos and the transition to a “new normal” is likely to pose a challenge or two for finance leaders.

One of the questions that has been on most finance leader’s minds is ‘What do I need to do today to conserve cash?’

While there is no one-size-fits-all approach, there are definitely certain winning playbooks that SaaS businesses can learn from. From my experience at having planned the scenarios and measures to extend the runway at Chargebee, I think what helped us was working with this framework.

There are two aspects to extending the cash runway of a company and they are,

- Cash conservation

- Customer retention

Step 1# Cut all discretionary spend

The first step to understand your cash runway is to segregate the spend. As a scaling business, this is something you’d have done throughout but when a business reaches the point of preservation or conservation, the segregation of spend becomes a major issue.

[Read: We asked 3 CEOs what tech trends will dominate post-COVID]

Start by avoiding discretionary spending – the spending that one can do away with. Here is where there is a difference. In a pandemic-triggered recession, the definition of discretionary spending would change. For example, when expenditure on travel and entertainment is an obvious discretionary spend, in the current times, the office space could also become a discretionary spend.

There is also a way to bring down non-discretionary spends. At Chargebee we identified big-budget annual payments and renegotiated contract terms to match our inflows. We broke down our cash inflows on a weekly basis and matched the expenses to the inflows bringing down big-ticket spends. At a functional level, gather your Revenue Operations Practitioners and eliminate tools that are redundant.

Step 2# Scenario planning

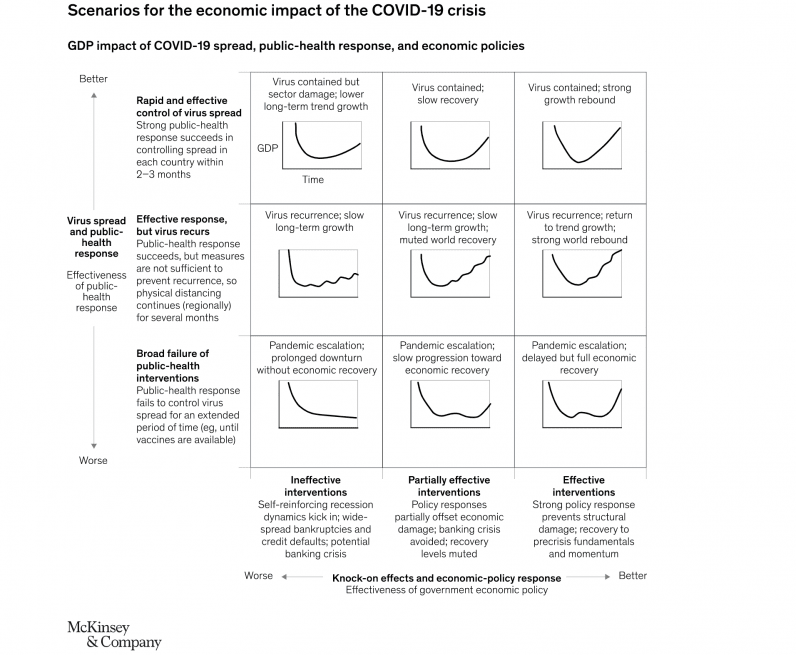

Around March 2020, McKinsey & Company tried predicting the different outcomes of the economic impact of COVID-19 with these 9 different curves.

Bloomberg has also predicted other types of recovery we could be seeing in the coming quarters. Whether it’s a V-shaped curve or a ‘Nike-Swoosh’, these predictions call for alterations to your pre-pandemic plans.

Here is where scenario planning comes into place. It should be performed after segregation the costs to help refocus the budget. Ask yourself,

What are the possible revenue goals I can achieve in these different scenarios?

The answer to this question will vary depending on the type and size of the company but an organization should have at least four different scenarios planned out at any given time.

Step 3# Plan revenue goals for the scenarios

Moving to the other side of the spectrum, you need to look into spend to match the anticipated revenue goals. Here discretionary spending is not taken into account. It is advisable to not commit to this spend until things get back to normal.

But what happens to plans made in an uncertain world?

As a measure to combat uncertainty, every finance leader should have a detailed plan on all the possible actions to take to reduce spend. Based on this, triggers and action items that need to be set in place.

As Dan Hockenmaier says, “Scenario planning is an exercise in deciding what to do before you get punched in the face.”

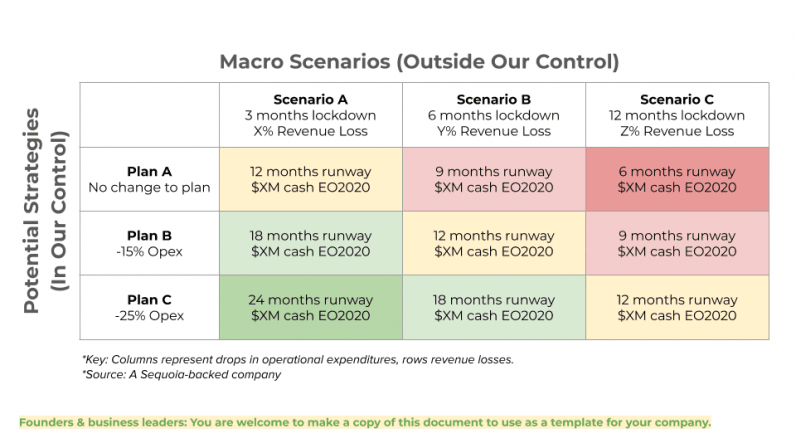

Scenario planning would help you understand how your company not only survives but thrives in different future scenarios for the country and its economy. Below is a template from Sequoia on how to map out and maintain a 24-month runway amidst controllable and uncontrollable factors in the environment.

Step 4# Define your end point

What is your cash balance at the end of the year? What is the runway you need in December of 2020?

When any crisis starts it is unlikely that the whole world shuts down. There are activities that keep the economy running even at a low pace of growth.

Generally, annual revenue targets are drawn out at the beginning of the financial year/calendar year but when there is a high level of uncertainty, these plans need to be revised every month or quarter depending on the severity of the impact for the business. This helps you take calculated decisions based on your spending patterns.

Step 5# Reforecasting to success

The final and most crucial step is reforecasting. It helps one stick to the plans. It also helps identify opportunities for growth and helps invest any excess funds in them.

“When you reforecast, you map the actuals to the scenarios. Which scenarios are you falling into? If you did really well, you have more funds to allocate elsewhere. This is critical.”

In our current times, macro-shifts are happening fast and micro-shifts within your business like up-sell or churn may still be slow. Speed of the company’s decision making becomes crucial and reforecasting on a quarterly basis helps do this.

Metrics in reforecasting

The following are the key metrics we use at Chargebee for the purpose of reforecasting.

- Customer Acquisition Cost (CAC)/ Customer Lifetime Value (LTV) ratio: Understanding the cost spent by marketing and sales to acquire a customer and the time the customer spends with us is vital. A ratio of 3 is acceptable.

- Net revenue retention (NRR): This metric gives a clear picture of the impact of customer success with your product. It is usually calculated on an annual basis but it can be calculated on a monthly basis in the given situation. A 1% improvement in churn can bump up your cash flows significantly as it saves on lost revenue, new CAC, and the effort on gaining new customers.

- Cash Runway and Net burn: As we saw, the cash runway is the amount of cash left for the business to function after the spend. It is now more important to focus on how much cash is burnt and how much is left.

How can a business plan its cash runway for the upcoming quarters?

Any company in the midst of this crisis should have a 24-month runway available for them.

If they do have it, then it is an indicator that they are on the right track of preserving and conserving cash.

To prioritize investments, companies should plan and consider the following spends,

- Is the money that is being spent in this quarter bringing in revenue in the next quarter?

- Does it reduce manual work by automation?

- Does it provide any long term benefits?

- Are there any immediate organizational risks that need to be taken care of like pending litigation or any spend to rectify the loss of reputation?

You can also consult with your board members/investors and if necessary, look for alternate sources of funding in the form of investments (e.g. venture debt funding, angel investors, grants, etc.).

What are some pitfalls to look out for?

In the current scenario, there are two areas that need more focus.

- Discretion to spend is important. Every cash decision at this point would have major repercussions and one should think through the different ways to deploy cash for best results.

- Reach out to good sources of investment. Even if a business has a good cash runway now, it is always best to have backups available. For example, due to the political unrest, investors from few countries might not be in a position to participate in future rounds of funding and so it becomes important to build relationships and get everyone on the investment team onboard here.

Macro factors can’t be predicted. A year ago if anyone would have told us that we would be sitting at home working as remote teams, we would have made light of the whole situation. However, some truths are inevitable and unfathomable.

But, having good sources of investments available to tap in even when we might not have the need for it at the moment and maintaining 24 months plus cash runway at any given point should help any company manage their cash runway and emerge stronger from the downturn.

So you’re interested in growing a business? Then join our online event, TNW2020, where you’ll hear how the most successful founders kickstarted and grew their companies.

Get the TNW newsletter

Get the most important tech news in your inbox each week.